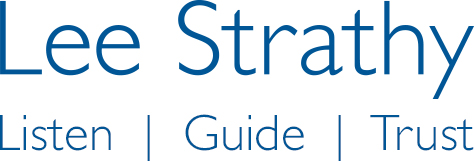

It’s not an understatement to say 2020 has been a roller-coaster ride for investors. At the beginning of the year there was optimism about 2020, then coronavirus hit, and the markets dropped significantly in March.

Then, despite the world economy stalling, the markets rallied, which in some cases provided dramatic growth on investments.

According to its 2021 Q1 roundup, JPMorgan reports the S&P 500 – the index that measures the stock performance of 500 large companies listed on stock exchanges in the United States – rose 4.4% in March of this year alone.

It also reports that the UK’s FTSE 100 index grew by 4.2% and the European Stoxx 50 index by 7.9%.

The below chart, shown in a BBC report, shows March’s gains come on the heels of a positive year for many indexes, which rallied at the end of 2020 after the initial downturn in March last year.

Source: BBC

With this in mind, there are many people who, during 2020, would have left their hard-earned money in savings (bank/building society accounts etc.), away from the ups and downs of investing. However, doing this meant they potentially missed out on growth. Read on to find out more.

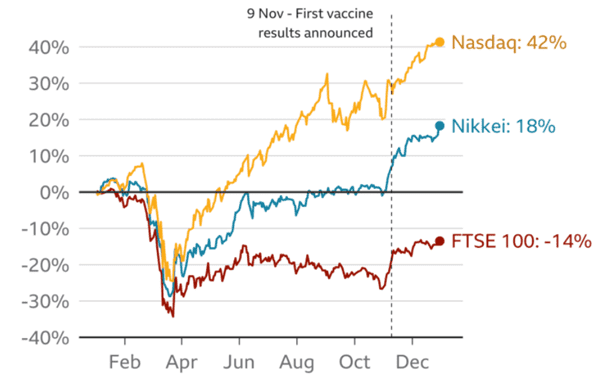

Interest rates for savings are historically low

The Bank of England (BoE) base rate still stands at just 0.1% after its Monetary Policy Committee (MPC) decided in March to maintain the historically low level.

Then, when savers thought it couldn’t get any worse, BoE gave high street lenders six months to prepare for negative interest rates but stressed that this didn’t mean another base rate cut was a certainty. Negative interest rates, however, mean you could end up paying your bank to hold your savings!

The below chart shows how average interest rates have fallen since June 2016, providing savers with dramatically reduced rates in 2021.

This highlights the low level of returns savers can now expect to get from high street banks.

Even National Savings & Investments (NS&I), which many savers saw as a safe haven as other lenders cut rates, slashed many of its rates at the end of 2020. Its popular NS&I’s Income Bonds account’s rate dropped from 1.16% to 0.01%, while its Direct Saver account’s rate fell from 1% to 0.15%.

Source: Which?

An increase in inflation is likely to eat into your savings

If low interest rates weren’t enough, the value of your money could also be eroded in real terms due to inflation.

Inflation is the rate at which the prices of goods and services increase. Currently inflation is 0.4%, yet in January it was 0.7%, meaning the rise in the cost of living was outstripping the interest being paid on savings accounts.

And things could get worse. There has been much speculation that, when the world returns to post-coronavirus normal, inflation will start to increase as consumer demand increases.

A report by Reuters says America expects economic growth to reach 6.5% this year and, according to a report in the Guardian, a rise in inflation across the world is looking likely.

However, while you may think rising inflation means rising interest rates, the Guardian points out that while governments are dealing with such a heavy debt burden, many will not want to see interest rates rise as this pushes up the amount they’ll pay to service the debt.

For this reason, central banks may delay raising interest rates when inflation rises, something that could further devalue your savings.

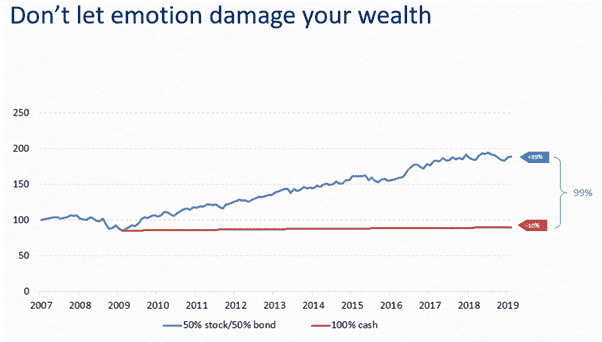

Investing means greater potential growth

Even when interest rates are closer to inflation, the long-term potential growth of investing could provide much greater returns.

The below graph by Vanguard shows that, if in 2007 you had invested £100,000 into a medium-risk investment, made up of 50:50 shares and bonds, it would have doubled in value by 2019. If you had put it in a savings account, it would have reduced by 10% in real terms.

This is backed up by the 2019 Barclays Equity Gilt Study, which tracked the nominal performance of £100 invested in cash, bonds or equities between 1899 and 2019.

It shows the stock market outperformed cash in 69% of two-year periods. If you extend that to ten-year periods, stock markets outperform cash 91% of the time.

It also shows that £100 invested in cash in 1899 would be worth just over £20,000 in 2019, yet if you had put the money into stocks and shares, it would have been worth around £2.7 million.

The most important thing to remember when investing is that it is a long-term venture. Typically, you should not invest for less than five years, and working with your financial planner means you will understand the investments being made, as well as the risks and potential rewards.

Get in touch

If you have savings that you would like to see potentially grow more, or have any questions about investing, please contact us below.

We work with clients as individuals, taking time to understand their financial needs and aims, and create a financial strategy with them to help them fulfil their goals, while providing peace of mind.

Please note

This article is for information only. Please do not act based on anything you might read in this article.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Your pension income could also be affected by the interest rates at the time you take your benefits. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.