In June 2021, the Office for National Statistics reported property prices had risen by 13.2%, the highest annual growth rate for nearly 17 years. While much has been made about the homebuyers’ race to beat the Stamp Duty holiday deadline, the BBC also revealed that low interest rates and changing home preferences may also have driven property inflation.

While this is good news for the value of your home, the Telegraph points out that the rise of property prices also carries tax implications if you’re selling one that’s not your principal residence.

This is because second homes are typically subject to Capital Gains Tax (CGT), the tax that’s due on most things you can sell – including some investments. Depending on how much you earn, and what you sell, the CGT rate ranges from 10% to 28%.

While you are allowed to make £12,300 from the sale of goods before CGT is due, this exemption was frozen for five years by chancellor Rishi Sunak in March 2021.

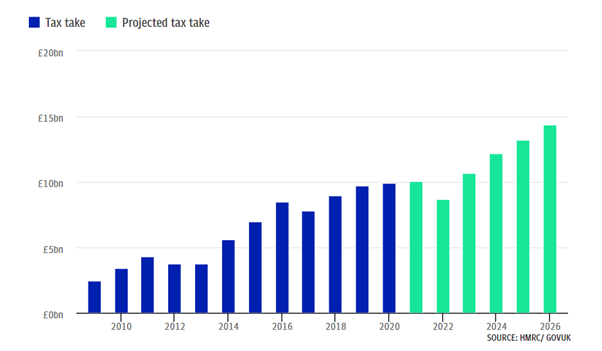

This freeze, the Telegraph points out, could now help increase the government’s CGT take over the next five years. This is illustrated in the following chart that shows government estimates of taxes it will take from the sale of investments and second properties.

As you can see, it predicts CGT receipts will rise from around £10 billion in 2019/20 to £14.4 billion by 2026.

Source: the Telegraph

There is good news though, as the government provides several bona fide ways to reduce your exposure to CGT. Read on to discover six ways to reduce your exposure to the tax.

- Offset a gain with a loss

Under HM Revenue and Customs rules, you can use losses from the previous 10 years to reduce the profit you have made. By deducting the loss from your gain, you can then reduce or potentially negate your exposure to CGT.

In addition, you may be able to deduct any costs associated with improving your asset, such as redecorating or refurbishing a second home or restoring a valuable painting.

- Split your assets with your spouse

You are allowed to transfer certain assets to your spouse or civil partner tax-free. If you gave your husband or wife some of your assets, it would mean they can also use their annual exemption, effectively doubling the household’s allowance to £24,600 (2021/22) before CGT will be due.

There may be tax implications of splitting assets, so talk to a financial planner first.

- Straddle the tax year end when selling

With certain investments, you may be able to sell your assets in two halves. This means you can sell one half just before the tax year end on 5 April, allowing you to use your CGT allowance for that tax year.

Then, by selling the other half at the beginning of the following tax year, which starts 6 April, you can use that year’s allowance. This effectively doubles your allowance.

- If applicable to you, apply for Business Asset Disposal Relief (BADR)

Formerly known as “Entrepreneurs’ Relief”, BADR allows you to sell certain business assets including shares for the CGT rate of 10%. This could include selling shares in the company you work for or a business you have built from scratch.

In 2020, a Lifetime Allowance of £1 million was introduced. This could mean you will not receive BADR if you have already made gains of more than this amount from selling shares or a company.

- Invest in an Enterprise Investment Scheme (EIS)

As the government wants to encourage investment into fledgling companies, investing in an EIS could provide deferral relief. This means you can delay any CGT due on the money you use to invest into the EIS.

The tax becomes due when you sell the EIS. You can defer the tax on any gains made up to three years before you invest in the EIS, or for one year after.

While these schemes potentially offer CGT benefits and potential growth, they’re typically seen as high-risk investments, so speak with your financial planner to ensure it’s right for you.

- Invest in a Stocks and Shares ISA

As these tax-efficient accounts are not liable to CGT, investing into a Stocks and Shares ISA means any investment growth won’t typically be liable to the tax.

While the 2021/22 ISA allowance is £20,000, if you invest in one over a number of years, you could build up a significant investment fund that could grow free of CGT.

Get in touch

If you would like to discuss your exposure to CGT and ways you could reduce it, please email advice@leestrathy.com or contact us on 01905 620545.

Please note

This article is for information only. Please do not act solely based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.